De-Dollarization: The emergence of the BRICS alliance

A growing number of nations throughout the world have expressed interest in finding alternatives to trading without the US dollar. Their concerns with the current system stems from the fact that for decades, western interests have led to struggles in non-NATO countries being able to conduct stable long-term monetary policies and trade with one another without some kind of foreign influence.

A more recent development comes directly from the Middle East, where Saudi Arabia and Iran– whose rivalry has been at the epicenter for most of the conflict in the region– have now come together to show interest in decreasing use of the petrodollar and becoming more focused in bartering with the Chinese yuan. This interest was recently solidified following the Chinese-brokered peace deal between the two countries, where they finally agreed to reopen diplomatic relations with one another, breaking a seven year precedent of turned backs.

The petrodollar (USD paid to oil-exporting countries) has been the sole payment method for Saudi and other oil producing countries’ petroleum, following the OPEC (Oil and Petroleum Exporting Countries) deal created by Richard Nixon and Henry Kissinger in 1973. Saudi Arabia and Iran, being two of OPEC’s most influential countries and China’s number one oil supplier, chose to use a world reserve currency like the petrodollar mostly to avoid tensions between each other. Now being open to each other, and at the hands of the Chinese, it is easy to put the pieces together and see what is really going on in this area. It is important to note that prior to the creation of the petrodollar, the USD was backed by the gold standard, which allowed it to be the most trustworthy payment method in years hitherto the petrodollar. Following the end of the gold standard, gold has gone from about $32 per ounce to roughly $2,000 per ounce at the time of me writing this – meaning that the US dollar’s value has gone down more than 50% since the 1970’s. Today, the dollar is backed by only the trust the people using it have, and with America having two major bank collapses in less than fifteen years, there is a growing global distrust of the USD.

The almost impossible peace deal struck between Iran and Saudi Arabia has been only one of several examples of Chinese backed economic deals throughout the world. And no, this development doesn’t only apply to the middle east, or small nations either. On March 28, 2023 China completed its first yuan settlement in liquified natural gas (LNG) with none other than France – one of the core members of NATO and of the UN Security Council. Although they haven’t quite yet managed to trade oil with China, a European country buying energy in yuan is a huge step towards the dominance of Chinese power globally. This only speaks to the desperation of European nations as gas and energy prices on the continent have been skyrocketing, partly due to the conflict between Russia and Ukraine. Russia and China have been two key factors to the oil and energy supply chain, and it’s not crazy to say that most of the world’s developed countries rely heavily on Chinese and Russian exports in general. On April 2, 2023 Japan broke G-7 rules by purchasing Russian oil above the $60-per-barrel price cap. The US gave them a special exception to do so, but this only goes to show how high of a demand there is for Russo-Chinese exports. Another example of the growing pricing power of the yuan is in Australia, where contractors are now accepting yuan for the nation’s largest and most lucrative export: iron ore.

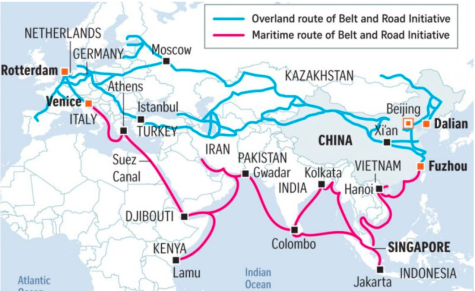

The encouragement from China for countries to start trading in yuan is a part of their broader plan for international reconstruction. In 2013, president Xi Xinping announced the Belt and Road Initiative, which according to the Council On Foreign Relations is “the vast collection of development and investment initiatives … originally devised to link East Asia and Europe through physical infrastructure.” The plan is simple: a two-pronged approach at investing in an overland physical “Silk Road”, and a maritime belt – hence, the “Belt and Road.” Since its launch, Xi has “financed a vast network of railways, energy pipelines, highways, and streamlined border crossings, both westward—through the mountainous former Soviet republics—and southward, to Pakistan, India, and the rest of Southeast Asia.” China has also been investing into developing infrastructure in the continents of South America, Oceana, and Africa in hopes to create a dominating worldwide reach. At a summit for Southeast Asian countries, Xi laid the groundwork for the maritime effort which would involve heavy investment into ports’ in strategic locations along the Indian Ocean all the way to Europe.

Over 147 countries, or 40% of the world’s GDP, have expressed great interest in being a part of this plan – the biggest of which being Russia.

This brings me to the connecting point between China, Russia, and the middle eastern countries. It is much easier to understand what I’m about to say if you think of these three countries (in order) as essentially the money supply, the arms supply, and the oil supply. Because of the new diplomatic relation between China and middle eastern countries, if any foreign nation (the US for example) tries to meddle with Saudi or Iran, Russia will come to the defense of this nation, and vice-versa. We have already seen escalated conflict here when just recently a US contractor and five other military personnel were killed and injured in a drone strike by Iranian backed forces in northern Syria. The drone used to attack these people is the same kind of weaponry that Iran has been selling to Russia for use in Ukraine over the past year (there is also rumors that because of supply issues, Russia will begin to mass produce Iranian suicide drones). Saudi Arabia has also been showing discontent for US influence when last year OPEC decided to cut oil production by two million barrels despite US pressure to delay the cut due to domestic inflation. All of this considered, it may not be erroneous to assume that in the coming time, Iran and potentially Saudi Arabia could soon join the BRICS alliance – Brazil, Russia, India, China, and South Africa.

“What is the BRICS alliance,” you may ask? Well as stated in the first paragraph there has been a growing sentiment worldwide that the USD has too much influence in certain countries. In 2009, countries with this concern created the initial BRIC bloc as a mechanism for the world’s leading emerging economies. In 2010 South Africa was invited to the alliance to encourage the promotion of “peace, security, development, and cooperation” – the BRICS bloc key message. What this means is a potential emergence of a very strong global power balance to US and Western influence. This balance of power has generated surprising support from some Western executives, including that of Jim O’Neill who is the former Chief economist of Goldman-Sachs, one of the largest multinational investment banks in the world. He states that “The U.S. dollar plays a far too dominant role in global finance… whenever the Federal Reserve Board has embarked on periods of monetary tightening, or the opposite, loosening, the consequences on the value of the dollar and the knock-on effects have been dramatic.” He believes that dollar dominance creates a burden to foreign countries that rely on a constantly fluctuating USD exchange rate. O’Neill believes that this growing bloc – which has shown interest from countries like Mexico, Indonesia, and Turkey to name a few – should work on cementing its power in worldwide institutions such as the International Monetary Fund and the World Bank. However, this would most likely never happen due to the fact that current BRICS nations hold less than 20% voting power at both institutions.

In order to understand why countries would want to make this unprecedented shift from Geneva or NYC to Beijing, it is important you follow the current debt-relations between said countries. China has become a major lender to debt-holding countries, providing $40.5 billion in international aid compared to the IMF’s $68.6 billion in 2021. Countries are becoming more willing to take loans in a more stable medium that – unlike the USD – is backed by gold, silver, and real estate. To build off of this point, Russian, Turkish, and Chinese central banks have created a large focus in the last ten years to hoard up as many natural resources as possible, such as gold and silver, providing a tangible safety net to an inflating currency.

No one can say for certain that the BRICS alliance or the yuan will override the USD as an official world currency, however, it’s important to recognize the growing influence that China and the BRICS countries are bringing to the world theater. Chairman Xi might not be able to maintain his “wolf warrior diplomacy” for much longer, as it is obvious in cases like the spy balloons’ that his administration is making some serious miscalculations. Countries all over the world are experiencing massive changes and shifts in food, energy, and manufacturing supply chains. Take Germany for example – their industrial model is currently heavily reliant on liquified natural gas to create their petrochemical system that essentially powers their manufacturing sector. BASF, the largest chemical producer in the world, is currently trying to move out of Germany and ship its manufacturing to places like Louisiana which still have a relatively stable energy supply. Many private manufacturing companies, not just in Europe, are in a testing phase where they are constantly moving to countries with more stability than where they are currently producing. US companies could really catch on to this trend early before it’s too late by creating better relations with closer countries like Canada and Mexico which have lots of natural resources and cheap skilled labor. It is imperative that the US rebuild regional trust diplomatically, while also maintaining its strength in the USD as the most essential currency in the world.

(He/Him) is a Junior at Shaker and is a part of the Podcast team in the Shaker Bison. He has been a member of the Bison for three years and is also active...